EB-2 (NIW) APPROVED FOR AN INTERNATIONAL LAWYER IN THE FIELD OF TAXATION

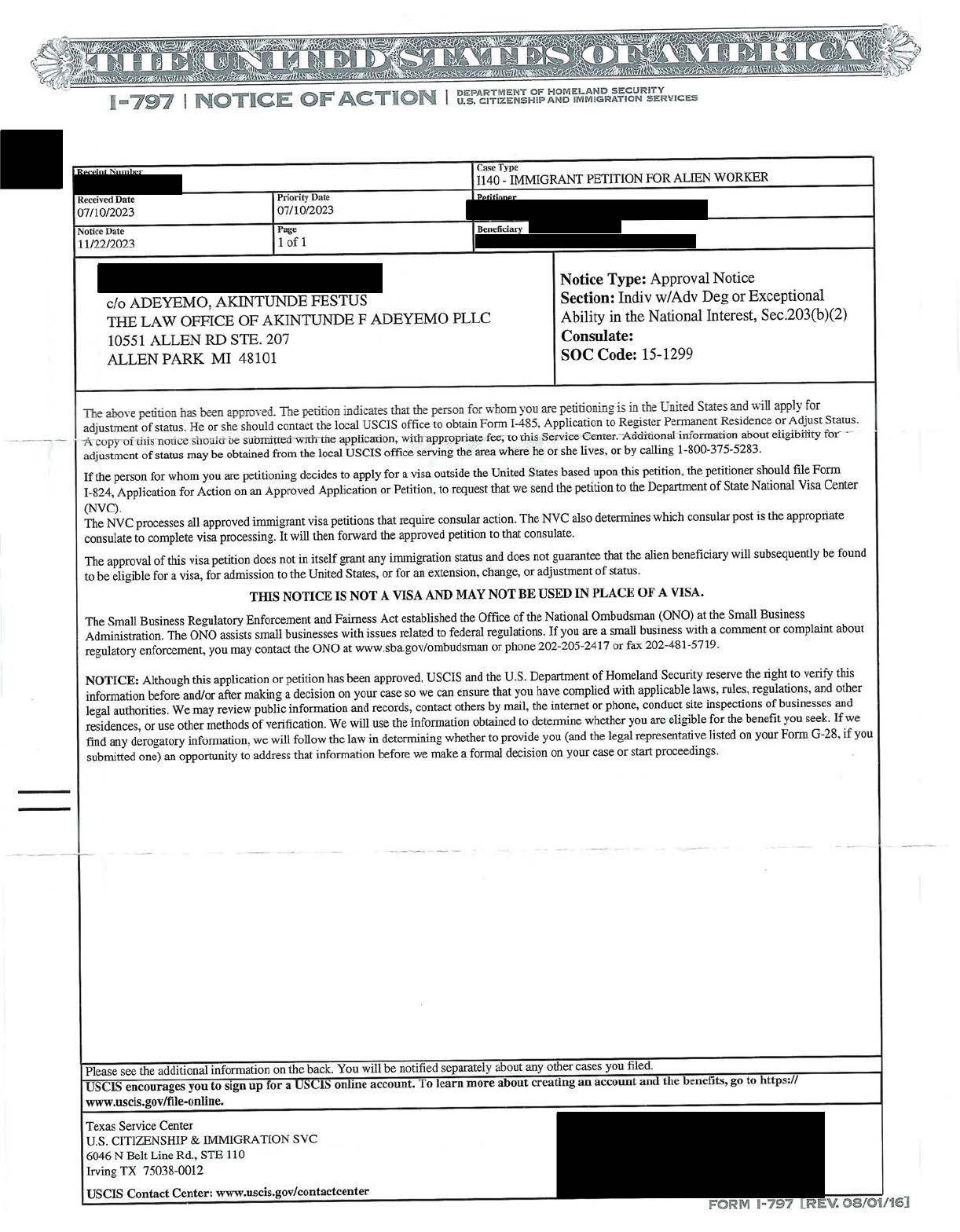

The Law Office of Akintunde F. Adeyemo, PLLC has successfully represented a client from Africa. U.S. Citizenship and Immigration Services (USCIS) delivered the Approval Notice to the firm’s address yesterday.

Having shared this life-changing news with our client — a versatile taxation expert — who was super excited to hear that his EB-2 (NIW) petition was approved by the USCIS, the firm would like to provide more insights into this case.

Procedural history:

On July 7, 2023 the firm filed this original EB-2 (NIW) brief (USCIS confirmed receipt on July 10, 2023). The original brief was expedited using the premium processing option (USCIS charges a separate fee to adjudicate a case within 45 days).

On August 4, 2023, USCIS made a request for additional evidence (RFE). Ouch! The client was worried; while an outright win is always good, some cases go all the way to the Administrative Appeals Office. The firm represents clients at every stage.

On October 18, 2023, the firm responded to the RFE request, submitting a supplemental brief and new evidence (you cannot submit the same evidence).

On November 27, 2023, we received the approval notice (USCIS mailed the notice on November 22, 2023). Though the case was approved last week, as a matter of law, the client’s priority date is July 10, 2023.

EB-2 (NIW) is an employment-based second preference (EB-2) - National Interest Waiver (NIW) petition, and it is one of the statutorily approved ways for qualified foreigners to become permanent residents in the U.S., and, subsequently, become U.S. citizens. For EB-2 (NIW), your location is irrelevant (the ultimate question is: can you satisfy the requirements under the Matter of Dhanasar, inter alia)? For our client who is in the U.S., as in the case at hand, his Green Card will be processed in the U.S. via the Adjustment of Status filing.

Our client, whose highest level of education at the time of filing was a Master of Laws in International Taxation, has a solid experience in designing cross-national and federal taxation strategies. Our client has been involved in research on cryptocurrency and blockchain tax issues, which are emerging areas that are useful for tax administration. Our brief specifically focuses on his unique skills and accomplishments in these emerging areas of taxation.

Inter alia, documenting his progressive accomplishments, which he accumulated in Africa and America, and connecting that to the national interest of the United States, the brief survives the first part of the first prong, the second prong, but triggered an RFE for the second part of the first prong and also the third prong.

The brief argues, inter alia, that his proposed endeavor will lead to projected future contributions by solving problems that the United States has deemed to be of substantial merit and national importance: optimizing tax revenue and reducing cases of tax evasion and tax noncompliance, particularly for digital assets and cryptocurrency transactions.

With his verifiable track record of successfully executing complex projects, including for a multinational firm, our client is well positioned to advance the proposed endeavor, the brief argues. Our client — who belongs to reputable professional groups (he was named a future leader in taxation) — has a deep knowledge of taxation that will inform stakeholders and policymakers on how to better integrate digital assets into our existing tax laws, as well as creatively enhance the current regulatory framework for the taxation of digital assets, the brief argues.

In drafting this brief, the firm had multiple touchpoints with the client. Understanding what the client does is very critical to filing an NIW brief. Moreover, by providing verifiable evidence, the brief argues that the client is the kind of talent that will advance the national interest of the United States. Based on our understanding of the client’s work, the brief focuses on our client’s prospective contribution to modern issues and practices relating to the taxation of digital assets. The brief further argues, among other things, that our client will leverage his deep understanding of blockchain technology to develop a scalable framework that will inform stakeholders and policymakers on the transformative possibilities that blockchain offers for the tax systems.

Additionally, the carefully written 30-page brief cites, as well as analyzes, different applicable laws, regulations, and pertinent evidence to corroborate the assertions. NIW cases are tricky, so you need to consider hiring a law firm/lawyer that understands all the nuances of the law. Before drafting every brief, we do comprehensive research on the AAO’s website, as well as review the Kurzban’s Immigration Law Sourcebook: NIW cases are won on the merit of the argument. Factual and legal arguments. In fact, it is an evidence-based petition. As in the case at hand, the firm submits verifiable evidence showing that our client possesses an impressive record of success in his field. To support this brief, the firm submits 117 exhibits. The firm submits verifiable evidence to show that our client has a stellar academic track record and professional expertise in the fields of taxation and emerging technology.

As previously mentioned, the initial brief did NOT survive all the three prongs of the analytical framework in the precedent decision Matter of Dhanasar, 26 I&N Dec. 884 (AAO 2016): (1) his proposed endeavor has both substantial merit and national importance; (2) that he is well positioned to advance the proposed endeavor; and (3) that, on balance, it would be beneficial to the United States to waive the requirements of a job offer and thus of a labor certification. And the brief establishes that he satisfies each eligibility requirement of the benefit sought by a preponderance of the evidence. Matter of Chawathe, 25 I& N Dec. 369, 375-76 (AAO 2010).

For the RFE brief, our legal strategy was to respectfully acknowledge the concerns raised in the RFE document. To cure the deficiencies, the brief highlights, inter alia, the national imperative of the proposed endeavor. The client’s proposed endeavor broadly impacts a matter that the Biden administration has described as having national importance or/and is the subject of national agenda. Evidently, the RFE brief argues, inter alia, that his proposed endeavor is altruistic in nature, as it will contribute to the United States’ efforts to develop a blockchain-based scalable tax framework to optimize tax revenue, compliance, and enforcement, thereby enhancing economic efficiency, fiscal sustainability and global competitiveness of the United States. These assertions were evidently corroborated by both independent experts and verifiable evidence showing his past and current contributions, including prestigious fellowships, awards and recognition, as well as active participation in key events (including events organized by the U.S. State Department, AFCTA and United Nations), book chapters. A certified decentralized finance (DeFi) expert through the Blockchain Council, our client has published numerous articles on topics that are pertinent to the proposed endeavor, the brief submits.

To satisfy the third prong of Dhanasar, relating to the question of whether it would be beneficial to the United States to waive the requirements of a job offer, and thus of a labor certification, the brief argues, inter alia, that his contributions to the field will undoubtedly benefit the United States. This is the trickiest legal analysis under the Matter of Dhanasar. There are lots of denied cases via the Administrative Appeals Office, so the firm usually considers the third prong as equally important as the first two prongs. Here, the legal analysis focuses on three of the factors enumerated by the Dhanasar Court: (1) whether, in light of the nature of our client’s qualifications or proposed endeavor, it would be impractical either for our client to secure a job offer or for him to obtain a labor certification; (2) whether, even assuming that other qualified U.S. workers are available, the United States would still benefit from our client’s contributions; and (3) whether the national interest in our client’s contributions is sufficiently urgent to warrant forgoing the labor certification process. This analysis is critical to winning an NIW case. You can read more about the Matter of Dhanasar on the firm’s website: www.akinalaw.com.

With this crucial phase now over, and while waiting for the priority date to kick in, our client will continue his work in the areas implicated in the proposed endeavor. This is a big win for the amazing Team at the firm. Most importantly, this is a big win for our client: a step closer to the American dream.

Again, congratulations to our client!

The Law Office of Akintunde F. Adeyemo, PLLC is now accepting new clients in the areas of EB-2 (NIW) and EB-1A.

To read more about EB-2 (NIW), visit: https://www.akinalaw.com/blog/11/a-permanent-residency-option-for-foreigners

To read more about EB-1A, visit: https://www.akinalaw.com/blog/18/eb-1a-frequently-asked-questions

For a free (100%) case evaluation for EB-1A/EB-2 (NIW), contact the attorney-in-charge of The Law Office of Akintunde F Adeyemo, PLLC:

Akintunde F. Adeyemo, Esq.

Attorney, Counselor & Solicitor

734-318-7053 (Call, Text, Including WhatsApp)

Website: www.akinalaw.com

Email address: info@akinalaw.com

#eb2niw #immigrationlawyer #immigrationattorney

***FOR INFORMATIONAL PURPOSES ONLY. PAST SUCCESS DOES NOT INDICATE THE LIKELIHOOD OF SUCCESS IN ANY FUTURE LEGAL REPRESENTATION***

***ATTORNEY ADVERTISING***